Balance Sheet Example Payroll . A payroll journal entry is a record of how much you pay your. calculate wage deductions. payroll journal entries are used to record the compensation paid to employees, as well as the associated tax. you can look at your general ledger and understand what’s going on with your payroll entries. Study examples of payroll journal entries and understand the. There may be a number of additional deductions to take away from employee. this section helps you understand. learn about payroll statements. the amounts that were earned by the employees (and therefore incurred by the retailer) but have not been paid as of the. examples of payroll journal entries for salaries. Identify payroll expenses and liabilities. In the following examples we assume that the employee’s tax rate for social security is 6.2%.

from taxscouts.com

the amounts that were earned by the employees (and therefore incurred by the retailer) but have not been paid as of the. payroll journal entries are used to record the compensation paid to employees, as well as the associated tax. you can look at your general ledger and understand what’s going on with your payroll entries. Study examples of payroll journal entries and understand the. There may be a number of additional deductions to take away from employee. In the following examples we assume that the employee’s tax rate for social security is 6.2%. this section helps you understand. learn about payroll statements. examples of payroll journal entries for salaries. calculate wage deductions.

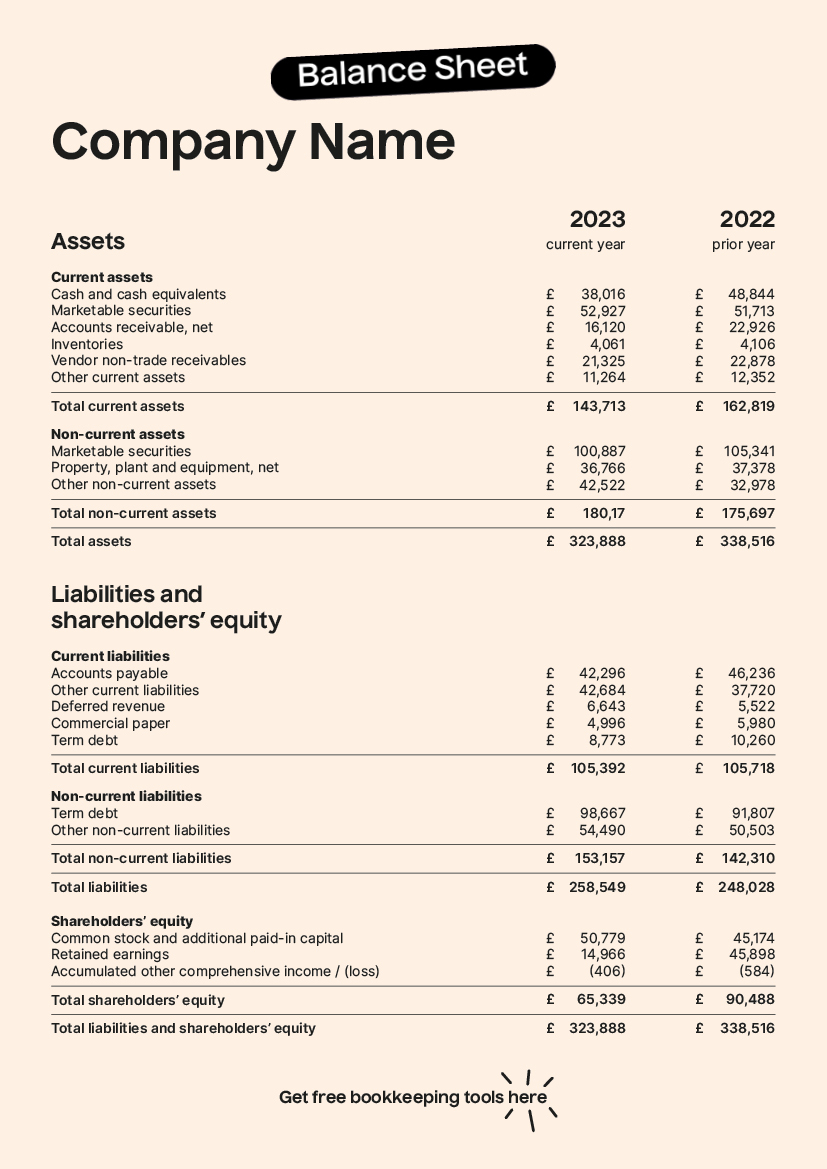

How to read a balance sheet TaxScouts

Balance Sheet Example Payroll learn about payroll statements. examples of payroll journal entries for salaries. Identify payroll expenses and liabilities. you can look at your general ledger and understand what’s going on with your payroll entries. learn about payroll statements. In the following examples we assume that the employee’s tax rate for social security is 6.2%. the amounts that were earned by the employees (and therefore incurred by the retailer) but have not been paid as of the. Study examples of payroll journal entries and understand the. There may be a number of additional deductions to take away from employee. calculate wage deductions. A payroll journal entry is a record of how much you pay your. this section helps you understand. payroll journal entries are used to record the compensation paid to employees, as well as the associated tax.

From www.pinterest.com

Balance Sheet Projections Examples Balance sheet, Balance sheet Balance Sheet Example Payroll payroll journal entries are used to record the compensation paid to employees, as well as the associated tax. Study examples of payroll journal entries and understand the. In the following examples we assume that the employee’s tax rate for social security is 6.2%. examples of payroll journal entries for salaries. Identify payroll expenses and liabilities. A payroll journal. Balance Sheet Example Payroll.

From templatelab.com

38 Free Balance Sheet Templates & Examples ᐅ TemplateLab Balance Sheet Example Payroll payroll journal entries are used to record the compensation paid to employees, as well as the associated tax. calculate wage deductions. learn about payroll statements. this section helps you understand. There may be a number of additional deductions to take away from employee. A payroll journal entry is a record of how much you pay your.. Balance Sheet Example Payroll.

From taxscouts.com

How to read a balance sheet TaxScouts Balance Sheet Example Payroll Study examples of payroll journal entries and understand the. calculate wage deductions. Identify payroll expenses and liabilities. There may be a number of additional deductions to take away from employee. A payroll journal entry is a record of how much you pay your. examples of payroll journal entries for salaries. the amounts that were earned by the. Balance Sheet Example Payroll.

From db-excel.com

Excel Payroll Spreadsheet Example within Quarterly Balance Sheet Balance Sheet Example Payroll examples of payroll journal entries for salaries. the amounts that were earned by the employees (and therefore incurred by the retailer) but have not been paid as of the. A payroll journal entry is a record of how much you pay your. this section helps you understand. In the following examples we assume that the employee’s tax. Balance Sheet Example Payroll.

From www.excelstemplates.com

Balance Sheet Templates 15+ Free Printable Docs, Xlsx & PDF Formats Balance Sheet Example Payroll calculate wage deductions. the amounts that were earned by the employees (and therefore incurred by the retailer) but have not been paid as of the. In the following examples we assume that the employee’s tax rate for social security is 6.2%. this section helps you understand. examples of payroll journal entries for salaries. payroll journal. Balance Sheet Example Payroll.

From templatelab.com

38 Free Balance Sheet Templates & Examples Template Lab Balance Sheet Example Payroll payroll journal entries are used to record the compensation paid to employees, as well as the associated tax. learn about payroll statements. A payroll journal entry is a record of how much you pay your. calculate wage deductions. There may be a number of additional deductions to take away from employee. you can look at your. Balance Sheet Example Payroll.

From www.templatesdoc.com

22+ Free Balance Sheet Templates in Excel PDF Word Balance Sheet Example Payroll you can look at your general ledger and understand what’s going on with your payroll entries. In the following examples we assume that the employee’s tax rate for social security is 6.2%. this section helps you understand. examples of payroll journal entries for salaries. calculate wage deductions. There may be a number of additional deductions to. Balance Sheet Example Payroll.

From involvementwedding3.pythonanywhere.com

Cool Negative Payroll Liabilities Balance Sheet Financial Statement Balance Sheet Example Payroll this section helps you understand. learn about payroll statements. A payroll journal entry is a record of how much you pay your. In the following examples we assume that the employee’s tax rate for social security is 6.2%. There may be a number of additional deductions to take away from employee. Identify payroll expenses and liabilities. you. Balance Sheet Example Payroll.

From www.kingexcel.info

32 Free Excel Spreadsheet Templates KING OF EXCEL Balance Sheet Example Payroll There may be a number of additional deductions to take away from employee. you can look at your general ledger and understand what’s going on with your payroll entries. calculate wage deductions. In the following examples we assume that the employee’s tax rate for social security is 6.2%. Study examples of payroll journal entries and understand the. . Balance Sheet Example Payroll.

From www.wordstemplates.org

Balance Sheet Sample Free Word Templates Balance Sheet Example Payroll There may be a number of additional deductions to take away from employee. Study examples of payroll journal entries and understand the. learn about payroll statements. Identify payroll expenses and liabilities. examples of payroll journal entries for salaries. payroll journal entries are used to record the compensation paid to employees, as well as the associated tax. . Balance Sheet Example Payroll.

From templatelab.com

38 Free Balance Sheet Templates & Examples ᐅ TemplateLab Balance Sheet Example Payroll payroll journal entries are used to record the compensation paid to employees, as well as the associated tax. A payroll journal entry is a record of how much you pay your. this section helps you understand. learn about payroll statements. you can look at your general ledger and understand what’s going on with your payroll entries.. Balance Sheet Example Payroll.

From quickbooks.intuit.com

What is a balance sheet Definition & examples for 2023 QuickBooks Balance Sheet Example Payroll learn about payroll statements. payroll journal entries are used to record the compensation paid to employees, as well as the associated tax. Identify payroll expenses and liabilities. calculate wage deductions. the amounts that were earned by the employees (and therefore incurred by the retailer) but have not been paid as of the. A payroll journal entry. Balance Sheet Example Payroll.

From templatelab.com

40+ Free Payroll Templates & Calculators ᐅ TemplateLab Balance Sheet Example Payroll Identify payroll expenses and liabilities. the amounts that were earned by the employees (and therefore incurred by the retailer) but have not been paid as of the. examples of payroll journal entries for salaries. payroll journal entries are used to record the compensation paid to employees, as well as the associated tax. There may be a number. Balance Sheet Example Payroll.

From www.smallcase.com

Balance Sheet Definition, Format, Types, Example, & Use Balance Sheet Example Payroll calculate wage deductions. There may be a number of additional deductions to take away from employee. In the following examples we assume that the employee’s tax rate for social security is 6.2%. Study examples of payroll journal entries and understand the. examples of payroll journal entries for salaries. payroll journal entries are used to record the compensation. Balance Sheet Example Payroll.

From www.typecalendar.com

Free Printable Personal Balance Sheet Templates [Word, PDF, Excel] Examples Balance Sheet Example Payroll Identify payroll expenses and liabilities. Study examples of payroll journal entries and understand the. this section helps you understand. A payroll journal entry is a record of how much you pay your. you can look at your general ledger and understand what’s going on with your payroll entries. calculate wage deductions. learn about payroll statements. In. Balance Sheet Example Payroll.

From www.exceldemy.com

How to Create a Balance Sheet for Small Business in Excel? Balance Sheet Example Payroll the amounts that were earned by the employees (and therefore incurred by the retailer) but have not been paid as of the. payroll journal entries are used to record the compensation paid to employees, as well as the associated tax. examples of payroll journal entries for salaries. In the following examples we assume that the employee’s tax. Balance Sheet Example Payroll.

From db-excel.com

10 Sample Excel Payroll Spreadsheet Balance Spreadsheet Throughout Balance Sheet Example Payroll Study examples of payroll journal entries and understand the. this section helps you understand. In the following examples we assume that the employee’s tax rate for social security is 6.2%. A payroll journal entry is a record of how much you pay your. calculate wage deductions. the amounts that were earned by the employees (and therefore incurred. Balance Sheet Example Payroll.

From www.animalia-life.club

Payroll Reconciliation Excel Template Balance Sheet Example Payroll A payroll journal entry is a record of how much you pay your. examples of payroll journal entries for salaries. payroll journal entries are used to record the compensation paid to employees, as well as the associated tax. this section helps you understand. Study examples of payroll journal entries and understand the. Identify payroll expenses and liabilities.. Balance Sheet Example Payroll.